I Was John Travolta. I must be John Travolta…why else would I put in my post yesterday that I love Jimmy Carson? JOHNNY Carson…I love JOHNNY Carson. Man! So if you’re completely lost as to why I would claim I’m John Travolta it’s because he monumentally screwed up the pronunciation of Idina Menzel’s name when he introduced her at the Oscars. IT WAS BEAUTIFUL…I’ve watched it a dozen times. See it here on Conan in first 20 seconds.

I Was John Travolta. I must be John Travolta…why else would I put in my post yesterday that I love Jimmy Carson? JOHNNY Carson…I love JOHNNY Carson. Man! So if you’re completely lost as to why I would claim I’m John Travolta it’s because he monumentally screwed up the pronunciation of Idina Menzel’s name when he introduced her at the Oscars. IT WAS BEAUTIFUL…I’ve watched it a dozen times. See it here on Conan in first 20 seconds.

Want to master the art of saying the wrong name? There’s a website for that. Yes, here you can enter any name and it will tell you exactly how John would say it…here’s your chance to be just like John Travolta. 🙂

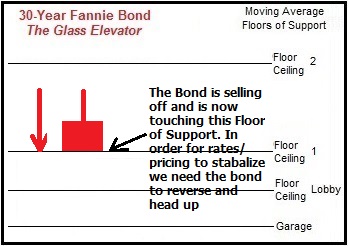

My Market Watch: Bonds Down Just -6bps. Jobs Report Tomorrow. The Fannie Mae 30-Year Bond is down but only by -6bps since yesterday’s close. Generally a lender’s rates/pricing get worse when the bond loses ground. I usually attribute 0.125 in price to about 20-25bps or so. So, since the bond is only down -6bps rates/pricing should be the same as yesterday.

My Market Watch: Bonds Down Just -6bps. Jobs Report Tomorrow. The Fannie Mae 30-Year Bond is down but only by -6bps since yesterday’s close. Generally a lender’s rates/pricing get worse when the bond loses ground. I usually attribute 0.125 in price to about 20-25bps or so. So, since the bond is only down -6bps rates/pricing should be the same as yesterday.

Tomorrow are the big Jobs and Unemployment Reports…these reports traditionally has the power to significantly influence trading. A trader’s job is to buy low and sell high. Therefore, traders try to predict what will happen and invest accordingly. If the either report is off, then traders will react based on how well they guessed.

The Jobs Report tells us how many new jobs were created in February and the Unemployment Rate tells what percentage is out of work. If the Jobs Report shows more new jobs than expected (indicating a stronger economy), then traders will invest in the stock market. In order to free up money to invest in stocks, traders will sell off bonds and when that happens our rates/pricing get worse. Conversely, if the Jobs Report shows less new jobs than expected (indicating a weaker economy), then traders will sell their stocks and invest in safer bonds instead. When that happens our rates/pricing get better. I hope that makes sense.

The Jobs Report tells us how many new jobs were created in February and the Unemployment Rate tells what percentage is out of work. If the Jobs Report shows more new jobs than expected (indicating a stronger economy), then traders will invest in the stock market. In order to free up money to invest in stocks, traders will sell off bonds and when that happens our rates/pricing get worse. Conversely, if the Jobs Report shows less new jobs than expected (indicating a weaker economy), then traders will sell their stocks and invest in safer bonds instead. When that happens our rates/pricing get better. I hope that makes sense.

The Unemployment Rate has a similar analysis…if the unemployment rate goes up, it means a weaker economy, right? More unemployed = weaker economy. If the unemployment rate goes down then the economy should be considered stronger.

Traders try to predict what will happen and react sharply when either report is significantly off. For example, if there are a ton more or less jobs created than expected, then the amount of stocks and bonds traders buy or sell goes up greatly. It is expected that 150,000 new jobs will be reported and the Unemployment Rate will be 6.6%. The number of expected new jobs seems low to me…I’m betting it comes in higher. Therefore I advise locking today before the report is published. But MBS Highway disagrees with me…they think less new jobs will be reported and they are recommending you float your locks until after the report is published.

Please do your own research and rely on the same before you decide to lock or float your loans. Feel free to call me to discuss….

My Disclaimer

“DADDY, IT’S ST. PATRICK’S DAY!!!!!” My son came into my room yesterday morning wearing every green shirt, pants and socks he could find, and, a green hat no less. I got it tapered down a little (notice I used e a financial term to explain) and this was the result. Not bad, eh? He was so excited for St. Patrick’s Day…every day since Wednesday last week he was asking when the big day would finally get here. Yesterday morning he woke me up at the crack of dawn (thank you very much) to tell me it had finally arrived…”DADDY, IT’S ST. PATRICK’S DAY!” Then he slammed the door shut and ran downstairs to make a poster for the Leprechaun, which is proudly displayed in the picture to your right. Now tell me that doesn’t bring a smile to your face.

“DADDY, IT’S ST. PATRICK’S DAY!!!!!” My son came into my room yesterday morning wearing every green shirt, pants and socks he could find, and, a green hat no less. I got it tapered down a little (notice I used e a financial term to explain) and this was the result. Not bad, eh? He was so excited for St. Patrick’s Day…every day since Wednesday last week he was asking when the big day would finally get here. Yesterday morning he woke me up at the crack of dawn (thank you very much) to tell me it had finally arrived…”DADDY, IT’S ST. PATRICK’S DAY!” Then he slammed the door shut and ran downstairs to make a poster for the Leprechaun, which is proudly displayed in the picture to your right. Now tell me that doesn’t bring a smile to your face.

This technology would have been awesome for a day like yesterday. French toast breakfast and then a long stretch of games in the backyard including coloring and tic-tac-toe with the 6-year old on the right and hangman and scrabble with the 9-year old on the left. Then the daily scramble to get out of the house and off to lunch, followed by a bare foot stroll along Torrey Pines State Beach.

This technology would have been awesome for a day like yesterday. French toast breakfast and then a long stretch of games in the backyard including coloring and tic-tac-toe with the 6-year old on the right and hangman and scrabble with the 9-year old on the left. Then the daily scramble to get out of the house and off to lunch, followed by a bare foot stroll along Torrey Pines State Beach.  In fact, just to turn it on for the beach section of the day would have been cool. Sure, we took a few pictures with our phones, but how cool would it be to have a 30x30x30x30x30x30… account of that 90-minute stretch? The remainder of the day was just as fun…swimming at the club, an ice cream break, and then home for BBQ dinner with the neighbors, complete with collective neighborhood puppy entertainment. This was a memorable day…in a matter of typing I’ve memorialized it here. But having a photographic account of this day would be something I would love to be able to see.

In fact, just to turn it on for the beach section of the day would have been cool. Sure, we took a few pictures with our phones, but how cool would it be to have a 30x30x30x30x30x30… account of that 90-minute stretch? The remainder of the day was just as fun…swimming at the club, an ice cream break, and then home for BBQ dinner with the neighbors, complete with collective neighborhood puppy entertainment. This was a memorable day…in a matter of typing I’ve memorialized it here. But having a photographic account of this day would be something I would love to be able to see. Crimea continues to be in the spotlight…I’m not exactly sure why this news is so significant to Americans but I suppose there must be some oil or other interest our government is looking at. One interesting note is Crimeans got the opportunity to vote on whether to join Russia…95% were in favor of it. But if you dig a little deeper you learn that their only other choice was to be independent, not to return to the Ukraine. Anyway, how this affects pricing is yet to be seen. Historically unrest in the world creates an unstable economic market for traders…usually this results in more bond trading since it’s a safer bet. We’ll have to wait and see what happens…

Crimea continues to be in the spotlight…I’m not exactly sure why this news is so significant to Americans but I suppose there must be some oil or other interest our government is looking at. One interesting note is Crimeans got the opportunity to vote on whether to join Russia…95% were in favor of it. But if you dig a little deeper you learn that their only other choice was to be independent, not to return to the Ukraine. Anyway, how this affects pricing is yet to be seen. Historically unrest in the world creates an unstable economic market for traders…usually this results in more bond trading since it’s a safer bet. We’ll have to wait and see what happens… A New Way To Read. I can read incredibly fast as long as comprehension isn’t taken into consideration. I always wanted to read faster, in fact long ago I took a speed-reading class…it taught how to read in chunks, you know, paragraph by paragraph. AND IT WORKED, I could read super-fast…but my comprehension got even worse…ugh! So, I stuck to the old fashion way of reading.

A New Way To Read. I can read incredibly fast as long as comprehension isn’t taken into consideration. I always wanted to read faster, in fact long ago I took a speed-reading class…it taught how to read in chunks, you know, paragraph by paragraph. AND IT WORKED, I could read super-fast…but my comprehension got even worse…ugh! So, I stuck to the old fashion way of reading. A-Wop-Baba-Lumop! My daughter turned 9-years old this weekend and for her birthday we had a party at the house…she invited seven girls. Being the Super-Mom she is my wife planned games such as charades and had a build-your-own-sundae-bar complete with fruit, whip cream and other and saucy toppings…yum!

A-Wop-Baba-Lumop! My daughter turned 9-years old this weekend and for her birthday we had a party at the house…she invited seven girls. Being the Super-Mom she is my wife planned games such as charades and had a build-your-own-sundae-bar complete with fruit, whip cream and other and saucy toppings…yum!

My Market Watch: Bonds Down Just -6bps. Jobs Report Tomorrow. The Fannie Mae 30-Year Bond is down but only by -6bps since yesterday’s close. Generally a lender’s rates/pricing get worse when the bond loses ground. I usually attribute 0.125 in price to about 20-25bps or so. So, since the bond is only down -6bps rates/pricing should be the same as yesterday.

My Market Watch: Bonds Down Just -6bps. Jobs Report Tomorrow. The Fannie Mae 30-Year Bond is down but only by -6bps since yesterday’s close. Generally a lender’s rates/pricing get worse when the bond loses ground. I usually attribute 0.125 in price to about 20-25bps or so. So, since the bond is only down -6bps rates/pricing should be the same as yesterday. The Jobs Report tells us how many new jobs were created in February and the Unemployment Rate tells what percentage is out of work. If the Jobs Report shows more new jobs than expected (indicating a stronger economy), then traders will invest in the stock market. In order to free up money to invest in stocks, traders will sell off bonds and when that happens our rates/pricing get worse. Conversely, if the Jobs Report shows less new jobs than expected (indicating a weaker economy), then traders will sell their stocks and invest in safer bonds instead. When that happens our rates/pricing get better. I hope that makes sense.

The Jobs Report tells us how many new jobs were created in February and the Unemployment Rate tells what percentage is out of work. If the Jobs Report shows more new jobs than expected (indicating a stronger economy), then traders will invest in the stock market. In order to free up money to invest in stocks, traders will sell off bonds and when that happens our rates/pricing get worse. Conversely, if the Jobs Report shows less new jobs than expected (indicating a weaker economy), then traders will sell their stocks and invest in safer bonds instead. When that happens our rates/pricing get better. I hope that makes sense.

My Market Watch: Bonds Flat +6bps. The Fannie Mae 30-Year Bond is flat, up just 6bps after a big sell-off yesterday. When traders sell off bonds our rates/pricing get worse. There really isn’t much going on, and without something more enticing to write about I won’t waste my time, or yours. I’ll keep an eye on things today and if something should spark my interest I’ll fill you in….

My Market Watch: Bonds Flat +6bps. The Fannie Mae 30-Year Bond is flat, up just 6bps after a big sell-off yesterday. When traders sell off bonds our rates/pricing get worse. There really isn’t much going on, and without something more enticing to write about I won’t waste my time, or yours. I’ll keep an eye on things today and if something should spark my interest I’ll fill you in…. So, Floor 1 is now a level of support…we expect traders to start buying at this point, unless some news or report gives them reason to keep selling off bonds. But now

So, Floor 1 is now a level of support…we expect traders to start buying at this point, unless some news or report gives them reason to keep selling off bonds. But now Top 10 Reasons We Watch The Oscars. As long as I record the Oscars so I can skip through the boring stuff, I like watching. I asked my wife and in-laws who were in town this weekend for their top reasons to watch the Oscars:

Top 10 Reasons We Watch The Oscars. As long as I record the Oscars so I can skip through the boring stuff, I like watching. I asked my wife and in-laws who were in town this weekend for their top reasons to watch the Oscars: