The Handmaid’s Tale.

The Handmaid’s Tale.

My wife and I discovered a new show called The Handmaid’s Tale and we’re absolutely hooked. In fact, we made a promise to each other that neither of us will watch it without the other, and that’s a big deal! The premise is that a radical group takes over the U.S. government and rolls back time on protected rights, i.e., gender equality. We just finished the first season and it’s completely freaking us out I think because it feels like it’s totally plausible for something like this to happen, or at least the way they tell the story it seems plausible. How am I supposed to concentrate on making business loans when all I can think about is this show?! Don’t worry, I’ve been distracted before and I always figure out a way to focus! Send in the loan!!! 👍😎

No Revenues? No Problem!

Let’s say your business owner needs a loan but her revenues are non-existent, or really low, or declining for that matter. With no revenues there’s no opportunity for a working capital loan, or is there?

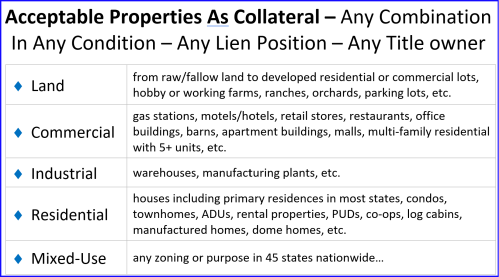

Assuming there is enough equity in one or all of their properties, we can include an interest reserve or subsidy fund to help them with their payments. Simply, we use money from the cash out of the loan and hold it back in an account to either (1) cover the entire loan payment for the entire term (or for a period of months) to give the Merchant time to get their revenues higher, and/or to (2) supplement and lower the payments for a period of months or for the entire loan term to make the payment more affordable! Put another way, we structure a loan the Merchant can qualify for and that makes sense for their current and future economics. The moral of the story is, always ask your Merchant/Borrower if they have real estate. If yes, then I’m your first call as a potential business lender. WBL will accept virtually ANY real estate type in ANY condition, and, we can use multiple properties together to max the lendable equity. They can use the loan for any business purpose.

After You Fund MCA Loan, Submit to WBL — Acceptable Properties As Collateral

After You Fund MCA Loan, Submit to WBL — Acceptable Properties As Collateral

Go ahead, fund the MCA loan now but don’t forget to ask the Merchant if they have real estate to pledge. If they do, then apply to WBL for another much larger loan. If there’s equity in the properties then there’s an excellent opportunity for them to qualify for a larger loan and you’ll earn another commission.

Remember, a Merchant can use any combination of properties to qualify. We’ll accept virtually any type of property in any condition, and, we’ll lend in junior lien position. The property can be owned by anyone as long as the owner also signs the loan documents, i.e., family, friend, business partner, etc.

Resource Links, Process & Loan Intake Instructions

Resource Links, Process & Loan Intake Instructions

Appointment Link – Get On Phil’s Calendar.

White Label Marketing Flyers Using Your Logo & Contact Information.

Flyer For Independent Sales Organization – ISO — Phil Grossfield

To Qualify For A Business Loan. (1) Equity in Real Estate – we’ll utilize virtually any type and combination of real estate in any condition, and (2) Revenues – sufficient to support/afford the loan payments. If they have these two, we can overcome just about any hurdle…

What Real Estate Will Be Acceptable As Collateral?

Process To Get Started. Email the loan opportunity to me and I will provide guidance…see below. At the same time, I will send it to our Intake Department to get their feedback on the real estate collateral, affordability, and any other considerations. On the same day or next, you and I will discuss and decide what to Offer your Merchant Borrower. If accepted, then we’ll send them an authorization form and formally submit the loan.

Email the Loan Opportunity To Me. Send me (1) an Application with all the Merchant/Borrower’s information including their mobile number and email address, (2) a full description of the real estate (use this Excel if necessary REO Schedule), and (3) a minimum 3-months business bank statements (6 months is better if you have it).

The Handmaid’s Tale.

The Handmaid’s Tale.

After You Fund MCA Loan, Submit to WBL — Acceptable Properties As Collateral

After You Fund MCA Loan, Submit to WBL — Acceptable Properties As Collateral Resource Links, Process & Loan Intake Instructions

Resource Links, Process & Loan Intake Instructions

Make Merchants Happy.

Make Merchants Happy.  Monthly Interest Only Loans.

Monthly Interest Only Loans.