Gaslighting The Kids.

Gaslighting The Kids.

The Elf on the Shelf started as a fun way to gaslight our children into believing in Santa. In case you’re unaware, gaslighting is making someone feel crazy for believing what they do…my wife accuses me of doing it to her all the time. Any way, now that my kids are 17 and 14, the Shelf-Elf is more about coming up with funny imaginative displays. I wish I had come up with the one on the right…it’s time to get our creativity geared up!

Fed Rate Will Likely Rise Again In December.

The Fed said inflation is still too high and that means it is very likely a 50-basis point rate hike is in the cards for December’s Fed meeting. This Friday the Jobs Report will be released and it always impacts the Fed’s decisions.

How Does Raising Fed Interest Rates Battle Inflation?

Simply put, the Fed raises rates to slow consumer spending so prices will fall…let me explain. The Fed controls the Fed Funds Rate which they have been raising in the hopes of indirectly changing consumers’ spending behavior…your spending behavior. By increasing the Fed Funds rate, they directly impact banks by making it more expensive for them to borrower money…yes, banks borrow money from each other all the time (but that’s another topic). If it costs more for a bank to borrow, guess who they pass that added expense to? Yep, it’s you! That makes it more expensive for us regular hard-working folks to borrow money. If it’s more expensive for us to borrow money, then we’ll borrow less, and when we borrow less, we spend less. That makes sense, right? So when we spend less as a community, then demand for consumer products will fall. When demand falls, prices will fall to encourage more spending. Stores will start putting goods on sale, and so on. Simple., got it?

SAY THIS:

SAY THIS:

Dear Merchant, would you ALSO care to apply for a working capital loan using your real estate as collateral?

Great job! You got a Merchant approved for an MCA loan! But did you ask them if they have real estate? Did you ask them if they would be interested in another loan…in addition to the MCA loan you just got them approved for? If they say yes, which they will 9 out of 10 times, then you have another opportunity for a commission…just send me their contact information and I’ll take it from there. You don’t have to do anything else…I’ll do all the work and when I close the loan, I’ll pay you full commission for the referral.

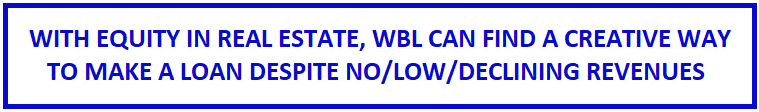

No Revenues? No Problem!

Let’s say your business owner needs a loan but her revenues are non-existent, or really low, or declining for that matter. With no revenues there’s no opportunity for a working capital loan, or is there?

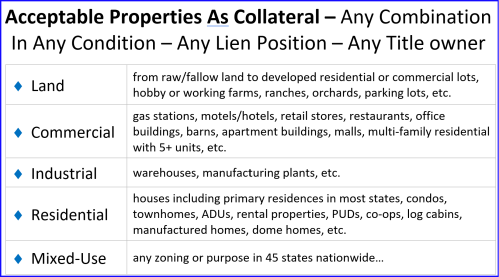

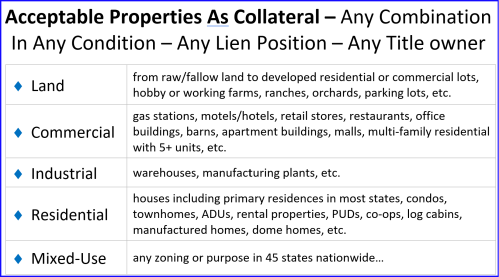

Assuming there is enough equity in one or all of their properties, we can include an interest reserve or subsidy fund to help them with their payments. Simply, we use money from the cash out of the loan and hold it back in an account to either (1) cover the entire loan payment for the entire term (or for a period of months) to give the Merchant time to get their revenues higher, and/or to (2) supplement and lower the payments for a period of months or for the entire loan term to make the payment more affordable! Put another way, we structure a loan the Merchant can qualify for and that makes sense for their current and future economics. The moral of the story is, always ask your Merchant/Borrower if they have real estate. If yes, then I’m your first call as a potential business lender. WBL will accept virtually ANY real estate type in ANY condition, and, we can use multiple properties together to max the lendable equity. They can use the loan for any business purpose.

Acceptable Properties As Collateral

Acceptable Properties As Collateral

Go ahead, fund the MCA loan now, but don’t forget to ask the Merchant if they have real estate because if they do another larger commission is close by. Apply for a loan with WBL at the same time as the MCA loan. Simply ask the Merchant if they would also like to use their real estate to apply for more working capital. 9 out of 10 times they’ll say yes:

DEAR MERCHANT, WOULD YOU ALSO LIKE TO APPLY FOR AN ADDITIONAL WORKING CAPITAL LOAN USING YOUR REAL ESTATE AS COLLATERAL?

Remember, a Merchant can use any combination of properties to qualify. We’ll accept virtually any type of property in any condition, and, we’ll lend in junior lien position. The property can be owned by anyone as long as the owner also signs the loan documents, i.e., family, friend, business partner, etc.

Gaslighting The Kids.

Gaslighting The Kids. SAY THIS:

SAY THIS:

Acceptable Properties As Collateral

Acceptable Properties As Collateral

Happy Halloween From Woody and Jessie!

Happy Halloween From Woody and Jessie!